Daniel McCann (Photo Credit: Saskatchewan Business Journal)

Daniel McCann wants to revolutionize the current online payment process used by millions of online shoppers when conducting online credit card transactions. During a telephone interview from his office in Regina, Saskatchewan, the 29 years-old inventor and entrepreneur told Your World Today that his new device has the potential of making the role of third-party security verification (Payment Gateways) obsolete.

And he should know what he is talking about. He was 26 when he first came up with the idea of a personal credit card reader; a fresh graduate of the University of Regina with a Bachelor degree in Computer Science. He entered his idea in a business plan competition sponsored by the Regina municipal government (called Progress2Capital) and placed in the top 10. He tried again the following year and won the first place prize of $10,000 in cash plus $5,000 in legal services. This was all the start-up capital he had to convert his idea from dream to reality.

A short three years later, and at age 29, Daniel is the President of a new technology company that employs 15 full-time employees. His invention is a patented reality, and is being sold online and through retail stores in Regina. He plans to offer the device in stores across Canada by mid to late summer of 2009.

I ask Daniel about his ‘big idea’, hoping that he would share his long-term vision of re-inventing the processing of online credit card transactions, and how the new process will cut the middleman out of the equation (Payment Gateways). He obliges.

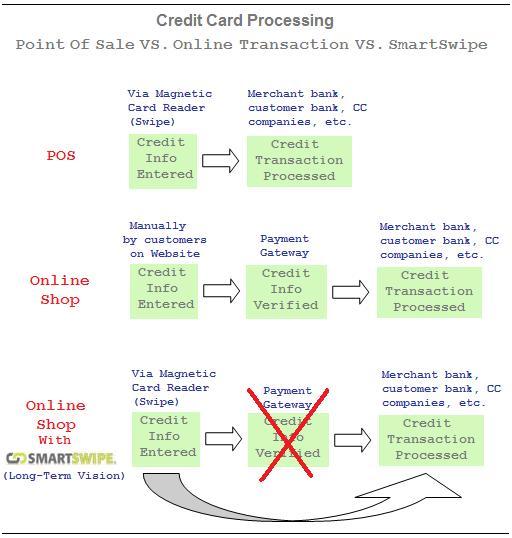

‘Payment Gateways’ are companies that are used by online shops to process online purchases made by credit cards. The extra encryption and transaction verification (that Payment Gateways provide) is required by banks and credit card companies to accept transactions from online shops because the credit card information is entered by consumers on a website by hand, which makes the transaction less secure than if the credit card was ’swiped’ at a point of sale (POS) terminal (e.g. : a retail store or restaurant transaction). When you pay for your bill with a credit card at a restaurant, the conventional store’s credit card reader retrieves the card’s information directly from the magnetic strip on the card and transmits it electronically to the merchant’s bank.

If Payment Gateways can be avoided, merchants and customers can save on transaction costs for shopping online by eliminating the percentage that the middlemen (gateways) charge on each sale to allow the use of credit cards on a website. This can translate into lower product prices for consumers, or higher margins for online merchants.

That vision will have to wait until enough people adopt the new portable device that he has invented in order to justify to merchants why they should go through the trouble of offering it as a payment option. If the technology becomes main stream, that will also convince banks and credit card processors to accept transaction info coming directly from a SmartSwipe device.

If that vision becomes reality, the impact on personal online shopping will be monumental. With the savings on transaction fees that online merchants can achieve by skipping the Payment Gateways, SmartSwipe can position itself as the next PayPal of the world.

For now, however, using the device allows online shoppers to automatically and securely fill the credit card fields in any existing online shopping transaction page. It is marketed as a safer alternative to entering credit card information manually on websites while shopping online.

The SmartSwipe website gives a good list of potential risks to watch for when shopping online. This personal/portable credit card reader allows the online shopper to avoid entering credit card information manually by swiping the card using the USB-connected SmartSwipe device. The information is then encrypted using the same encryption technology required by banks, and transferred directly into the appropriate credit card fields on the website where the shopper is conducting the transaction.

Daniel was kind enough to send Your World Today a demo unit. I tested the SmartSwipe with a couple of online credit card purchases and everything worked as advertised. The software didn’t activate automatically when testing a credit card transaction on Firefox (version 3.0.8), but worked without glitches in Internet Explorer (version 7.0.6).

Stay tuned for Part 2 of this article, where Daniel McCann shares with YWT readers the journey of his invention from idea to reality, and provides valuable advice to similar entrepreneurs about patenting, raising capital, product design, and how online social networking played a crucial part in the invention process.

Related posts:

- Semacode Technology In New Ad Campaigns Facilitate Impulse Shopping

- Semacode Technology: Take Two. The Facebook Chronicles.

- Nova Scotia Pomegranate Phone: Great Viral, but is it effective?