In the world of investment, you’re always searching for opportunities that balance stability with significant growth potential. Look no further than farmland.

As you’ll learn in a moment, this asset class consistently delivers on both fronts. The rising global population and increasing demand for agricultural products are driving up the value of rural land, resulting in a steady appreciation that’s tough to find elsewhere.

But farmland investment is more than just a safe bet; it’s an opportunity to contribute to a critical industry, generate passive income, and enjoy the benefits of tax breaks.

Diversifying your portfolio with farmland isn’t just a savvy financial move; it’s a strategic one. This asset class is an effective hedge against inflation, offering dependable growth without the price volatility common in other markets.

Whether you’re an experienced investor or just starting out, this article will shed light on the benefits and processes of investing in farmland, helping you reap rewards in more ways than one.

Key Takeaways

– Farmland investment offers stability and significant growth potential.

– Farmland is an effective hedge against inflation.

– Rental income from farmland can serve as a steady stream of passive income.

– Investing in farmland enhances portfolio diversification and mitigates market volatility.

The Basics of Farmland Investment

If you’re looking to diversify your investment portfolio, farmland’s a solid bet that’s not only a tangible asset but also a steady earner with plenty of tax benefits to boot.

The value of farmland tends to rise over time, giving you land appreciation – a key component of long-term growth. Plus, if you invest in Ontario farms for sales, you can earn rental income by leasing out your land to farmers, renewable energy companies, or recreational users. This passive income stream can provide a steady cash flow, contributing to your overall financial stability.

Additionally, owning farmland opens up opportunities for you to leverage agricultural technology, which can enhance productivity and increase the value of your investment.

On top of these financial benefits, investing in farmland also allows you to play an active role in land management. You can decide how your land is used and what crops are grown on it, thereby directly influencing its productivity and value. This can be a rewarding experience, giving you a sense of control and satisfaction that’s often missing from other types of investments.

Lastly, let’s not forget the tax breaks and exemptions that come with farmland ownership. These can significantly lower your tax burden, making your investment even more profitable.

With all these advantages, it’s clear that farmland investment can offer an excellent balance of risk and reward, making it a worthwhile addition to any investment portfolio.

The Stability of the Agriculture Industry

You’ll find that the agricultural industry’s stability is a comforting constant in the ever-changing world of investments. This sector is regarded as one of the most resilient, which makes farmland a reliable investment for long-term growth.

It’s an industry that remains steady even in times of economic turmoil because, regardless of market fluctuations, people will always need food, ensuring food security. Furthermore, the continuous advancements in agricultural technology are geared towards increasing crop yields and making farming more efficient, increasing the value of farmland.

However, it’s important to remember that, like any investment, farmland also comes with its own set of risks. Firstly, the impact of weather and climate risks cannot be underestimated. Extreme weather conditions, such as droughts or floods, can negatively affect crop yields. Secondly, global trade and market dynamics play a significant role in the agricultural sector. Changes in trade policies or market demand can affect the prices of crops.

But, despite these challenges, the stability of the agricultural industry is undeniable.

Here are three key reasons:

- Long-term growth: Over the years, farmland has shown steady appreciation in value, making it a promising investment for long-term growth.

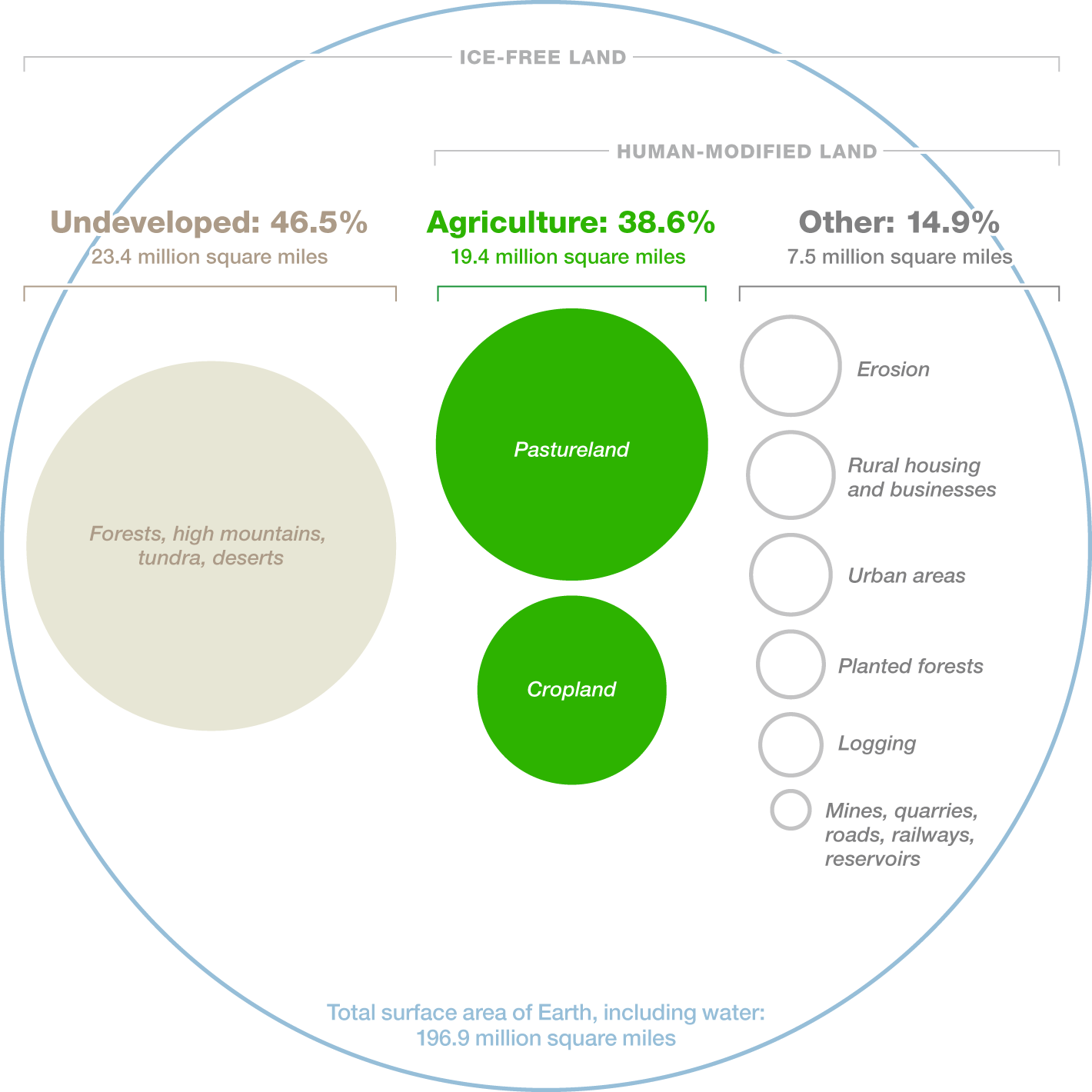

- Food security: The increasing global population will require to double the amount of crops by 2050. This ensures a continuous demand for farmland.

Source: https://www.nationalgeographic.com/foodfeatures/feeding-9-billion/ - Technology advancements: The integration of technology in farming practices boosts efficiency and productivity, increasing the value and profitability of farmland.

Financial Advantages of Investing in Rural Property

Let’s dive into the financial advantages that investing in rural property can bring your way.

One of the biggest perks is the profit potential that farmland offers. With the increasing global population and the corresponding demand for crops, the value of farmland is set to keep rising. This rural property appreciation not only ensures a promising return on investment but also provides long-term asset preservation.

Your investment in farmland isn’t just a short-term venture; it’s a tangible asset that’s likely to hold its value and grow steadily over time, providing a secure foundation for your financial future.

The financial benefits don’t stop there. Investing in rural property opens up rental income opportunities that can provide a steady stream of passive income. You could lease your land to farmers, renewable energy companies, or even recreational users, turning your investment into a cash-generating asset.

Moreover, your farmland investment can serve as a hedge against inflation. As the cost of living increases, the value of your farmland investment will likely rise too, protecting your wealth from the eroding effects of inflation.

Environmental Impact and Sustainability

Switching gears, it’s essential to consider the environmental implications and sustainability when looking at rural property investments. Beyond the financial returns, investing in farmland provides an opportunity to contribute positively to the environment.

The implementation of soil conservation techniques and water management strategies can significantly boost the land’s productivity and health. This could involve practices like contour plowing, crop rotation, or the use of cover crops to prevent soil erosion.

Water management, on the other hand, could include installing efficient irrigation systems or implementing rainwater harvesting methods to reduce water waste and ensure adequate water supply for crops.

In addition to these strategies, farmland offers renewable energy opportunities, with the potential for wind or solar farms that can generate clean energy and additional income. Furthermore, sustainable farming practices can help mitigate the impact of climate change on farmland by promoting biodiversity, reducing greenhouse gas emissions, and improving the resilience of the farm ecosystem.

With the right management, your farmland investment can become a testament to environmentally conscious and sustainable practices, reaping not only financial but also environmental rewards.

Diversification of Your Portfolio

Incorporating farmland into your financial strategy can significantly enhance the diversity of your portfolio, providing a sturdy buffer against market volatility. Unlike traditional stocks and bonds, farmland is an alternative investment that offers a unique blend of stability and growth potential. Its value isn’t directly tied to the whims of the stock market, which makes it an effective instrument for risk mitigation.

Additionally, farmland can provide a steady stream of income generation from leasing the land to farmers or other entities. Over time, the combination of income and appreciation can deliver robust long-term growth.

Here are some key benefits you can expect from adding farmland to your asset allocation:

– Strong Risk-Adjusted Returns: Farmland investment can provide competitive returns compared to other asset classes, with less volatility.

– Natural Hedge Against Inflation: The value of farmland typically keeps pace with inflation, preserving the purchasing power of your investment.

– Stable and Predictable Cash Flow: Leasing farmland to farmers or other parties can provide a consistent income stream.

– Potential for Capital Appreciation: As the global demand for food continues to increase, the value of farmland is likely to rise.

– Positive Impact on Local Communities: Investing in farmland supports local agriculture, contributing to the economy and food security.

Investing in farmland can be a strategic move to diversify your portfolio, providing both financial benefits and a sense of contribution to a vital sector of the economy.

Potential Tax Advantages

As you diversify your portfolio with farmland investment, another significant advantage worth considering is the potential tax benefits. Savvy tax planning can play a crucial role in maximizing your investment returns, and farmland offers a unique set of tax advantages that can further enhance your investment strategy.

One of the primary tax advantages of owning farmland is the potential for capital gains. When farmland appreciates in value, and you sell it for more than you bought it, the profit is considered a capital gain, which generally has lower tax rates than ordinary income.

Additionally, there are potential depreciation benefits. As a farmland owner, you can depreciate the value of improvements, such as buildings or irrigation systems, over time, which can provide significant tax deductions.

Moreover, a 1031 exchange, a provision in the tax code, allows you to defer paying capital gains taxes if you reinvest the proceeds from the sale of your farmland into a similar type of investment property.

Remember, tax advantages can add substantial value to your investment, making farmland even more appealing.

Frequently Asked Questions

How does farmland investment contribute to local community development and economic growth?

Investing in farmland fosters sustainable farming, aiding community empowerment. It spurs local job creation, bolsters food security, and promotes rural tourism. This vital contribution aids local economic growth and community development.

What are some practical steps to take when considering investing in farmland for the first time?

Start with an investment analysis to understand potential returns. Consider risk management strategies and succession planning. Educate yourself on farmland legislation and embrace sustainable practices to ensure a successful and responsible investment in farmland.

How does farmland investment align with long-term retirement planning and financial independence?

Investing in farmland offers investment diversification and retirement security. Farmland appreciation ensures steady growth while generating passive income. It also builds an agricultural legacy, fortifying your financial independence in long-term retirement planning.